In today’s fast-paced financial world, securing passive income has become a priority for many investors. Among the many options available, index funds stand out as an accessible, low-cost, and efficient way to build passive income, particularly for Indian investors.

Updated on 15Jan 2025, 12:23 AM

Fig: Index fund; credit: Shutterstock

Overview of Index Funds as a Tool for Passive Income

Index funds are mutual funds designed to mirror the performance of a stock market index, such as the Nifty 50 or the Sensex. They allow investors to gain exposure to a broad range of companies, reducing the risks associated with investing in individual stocks.

Since they are passively managed, index funds are often less costly than actively managed mutual funds, making them an excellent option for generating passive income.

Importance of Passive Income and Why Index Funds Are a Good Option

Passive income streams, such as interest from savings accounts or rental income, require little to no active involvement. Investing in index funds is a strategic way to create such income, as the investor doesn’t need to constantly monitor the market or adjust their portfolio.

Additionally, index funds offer diversification, meaning they spread investment risk across multiple companies, reducing the impact of any one company’s poor performance. This makes them ideal for long-term wealth building.

The Indian Market’s Growing Appeal for Index Fund Investors

The Indian economy is growing rapidly, with companies across sectors expanding their global footprint. Index funds in India have become increasingly popular as more people recognize the benefits of low-cost, diversified investment strategies.

Given the projected economic growth and favorable demographic trends, India’s market offers considerable opportunities for index fund investors seeking stable, passive income streams.

What Are Index Funds?

Definition and Explanation of Index Funds

Index funds are mutual funds that replicate the performance of a specific stock market index. An index is essentially a collection of stocks representing a segment of the financial market.

For instance, the Nifty 50 includes the 50 largest publicly traded companies on the National Stock Exchange of India (NSE), while the Sensex represents the 30 largest companies on the Bombay Stock Exchange (BSE).

How They Work: Tracking a Stock Market Index

Index funds are designed to replicate, or “track,” the performance of a particular index. If the Nifty 50 rises by 5%, an index fund that tracks the Nifty 50 will also increase by a similar percentage, minus management fees.

These funds automatically adjust their holdings to reflect the composition of the underlying index, requiring minimal intervention from fund managers.

Comparison Between Index Funds and Actively Managed Funds

Unlike actively managed mutual funds, where fund managers make regular decisions on which stocks to buy or sell, index funds simply mirror an index. This passive management results in significantly lower fees and expenses.

Moreover, historical data has shown that over the long term, many actively managed funds struggle to consistently outperform their benchmark indices, making index funds an attractive alternative for risk-averse, long-term investors.

Why Invest in Index Funds?

Benefits of Index Funds for Passive Income Seekers

For those looking to build passive income, index funds offer numerous benefits:

- Low Fees and Expenses: Since index funds are passively managed, they have lower management fees compared to actively managed funds.

- Diversification: Index funds spread investments across a wide range of stocks, reducing risk.

- Reduced Risk: By investing in a portfolio of companies, the risk associated with individual stock volatility is minimized.

- Long-term Growth Potential: Historically, stock market indices like the Nifty 50 and Sensex have shown strong growth, providing long-term investors with substantial returns.

Long-Term Growth Potential in the Indian Market

India’s market is projected to experience significant growth over the next few decades. Investing in index funds that track major indices like the Nifty 50 allows you to participate in this growth, making them a promising option for investors seeking to build wealth over the long term.

Types of Index Funds in India

Nifty 50 Index Fund

Tracks the Nifty 50 index, representing the top 50 companies in India by market capitalization. This is one of the most popular and widely invested index funds in the country.

Sensex Index Fund

This fund tracks the Sensex, which includes the top 30 companies listed on the BSE. It offers exposure to some of India’s largest and most stable companies.

Nifty Next 50 Index Fund

For investors seeking slightly higher growth potential, the Nifty Next 50 index fund tracks companies ranked 51-100 on the NSE, offering exposure to mid-sized firms.

Sectoral or Thematic Index Funds

Some index funds focus on specific sectors such as banking, technology, or pharmaceuticals. These funds allow investors to target sectors expected to outperform the broader market, although they typically come with higher risk levels.

Comparison of Risk Levels and Performance

- Nifty 50 and Sensex Index Funds: Lower risk due to their large-cap, stable company holdings.

- Nifty Next 50: Slightly higher risk with potential for greater returns, thanks to its inclusion of mid-cap stocks.

- Sectoral Index Funds: Higher risk due to concentration in specific industries, but can offer substantial returns if the sector performs well.

How to Choose the Best Index Fund

Factors to Consider

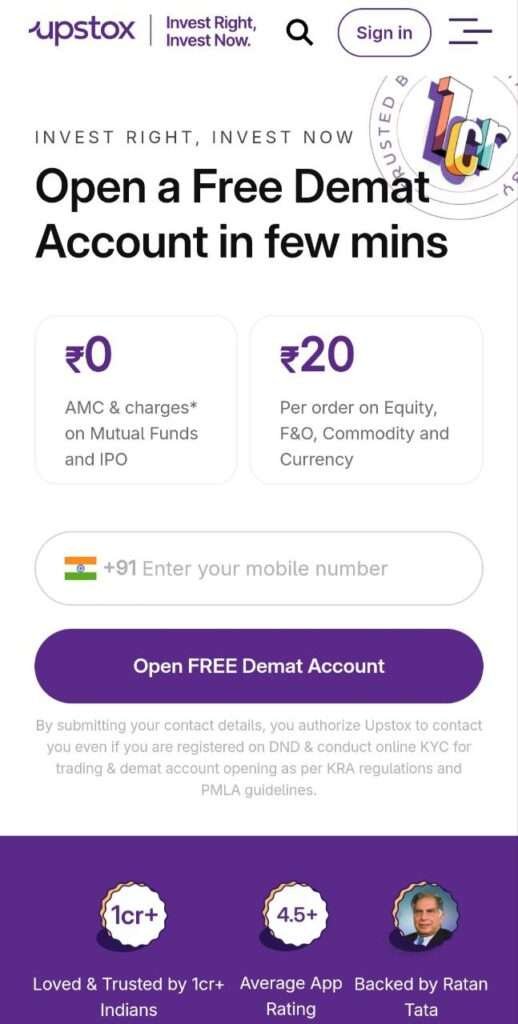

Fig: Expense ratio calculation

- Expense Ratio: This represents the annual cost of managing the fund. Lower expense ratios lead to better long-term returns.

- Tracking Error: The difference between the fund’s performance and the index it tracks. Lower tracking error is better.

- Fund Size: Larger funds often have better liquidity and lower volatility.

Historical Performance and Growth Outlook

Evaluate a fund’s historical performance, but don’t rely on past results alone. Consider future growth prospects for the index and its underlying companies.

Investment Goals: Long-Term Wealth Building vs. Short-Term Gains

For passive income, index funds are best suited to long-term investment strategies rather than short-term gains. Stay invested for a longer period to maximize returns.

How to Start Investing in Index Funds

Step-by-Step Guide to Start Investing:

1. Choose a Brokerage or Mutual Fund Platform

When choosing an investment brokerage platform, several key factors should be considered to ensure you select one that meets your financial goals and needs. Here’s a checklist of important criteria:

a. Fees and Charges

- Account Opening Fees: Check if there’s a one-time account opening fee.

- Brokerage Fees: Review the commission structure, including charges for buying and selling stocks, mutual funds, or index funds.

- Annual Maintenance Fees: Be aware of any recurring charges for maintaining your Demat account.

- Hidden Charges: Look for any additional charges for fund transfers, research services, or inactivity fees.

b. Investment Options

- Range of Products: Ensure the platform offers a wide range of investment options, including stocks, mutual funds, exchange-traded funds (ETFs), bonds, commodities, and even international stocks.

- SIP Options: If you’re planning to set up Systematic Investment Plans (SIPs), ensure the platform allows easy SIP setup with multiple fund options.

c. Ease of Use

- User Interface: The platform should have an intuitive interface that allows you to easily navigate through features, track your portfolio, and place trades.

- Mobile App: If you prefer trading on the go, check if the platform offers a functional mobile app with all the necessary tools.

- Research and Tools: Platforms with built-in research reports, financial news, stock screeners, and market analysis tools can be helpful for informed decision-making.

d. Customer Support

- Availability: Good customer service is essential. Check for available channels (phone, email, chat) and response times.

- Quality of Service: Look for reviews and user feedback about their support services in case you encounter any issues.

e. Security Features

- Regulation: Ensure the platform is registered with the Securities and Exchange Board of India (SEBI) to ensure regulatory compliance.

- Data Encryption: The platform should offer strong encryption to safeguard personal and financial information.

- 2-Factor Authentication: For added security, choose platforms that offer two-factor authentication (2FA) to protect your account from unauthorized access.

f. Platform Reliability

- Stability: Choose a brokerage that is stable and well-established. Platforms with consistent technical problems, outages, or slow trading execution can be frustrating.

- Speed of Trade Execution: Ensure the platform executes trades quickly and accurately, especially if you’re planning to engage in active trading.

g. Minimum Investment Requirements

- Some platforms may have a minimum balance requirement or a minimum investment amount for certain assets (e.g., mutual funds, ETFs). Make sure these align with your financial capacity.

h. Educational Resources

- If you’re a beginner, look for platforms that offer tutorials, articles, webinars, and other learning materials to help you understand investing better.

i. Withdrawal Process and Flexibility

- Check how easy it is to withdraw funds from your account and the processing times involved. Also, ensure the platform supports your preferred payment methods for deposits and withdrawals.

j. Reputation and Reviews

- Research user feedback and reviews for the brokerage platform to understand its pros and cons from an actual user perspective. Platforms with consistently positive reviews are more trustworthy.

k. International Access

- If you plan to invest in international stocks or funds, ensure the platform supports global markets and allows you to diversify beyond India.

l. Tax Reporting and Integration

- Some platforms offer automatic tax reports and transaction summaries, which can be helpful when filing returns.

m. Popular Platforms in India:

- Axis Direct

- Zerodha

- Groww

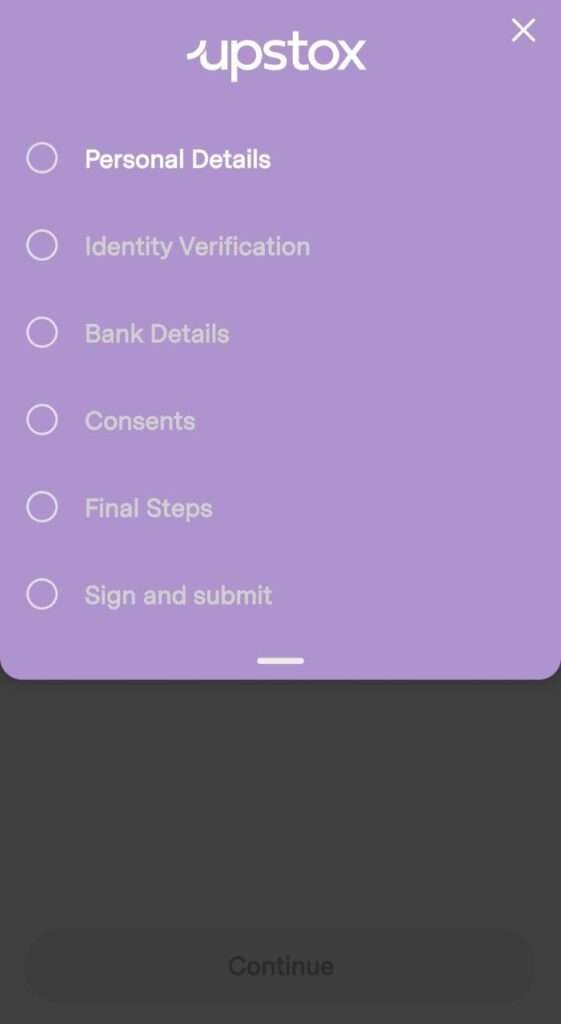

- Upstox

- HDFC Securities

- ICICI Direct

2. Set Up a Demat Account:

A Demat account is required to hold your investment units in digital form.

Step 1: Sign in with Your Mobile Number

- You will be prompted to enter your mobile number and email address.

- Click on the ‘Send OTP’ button.

- Verify the OTP sent to your mobile number.

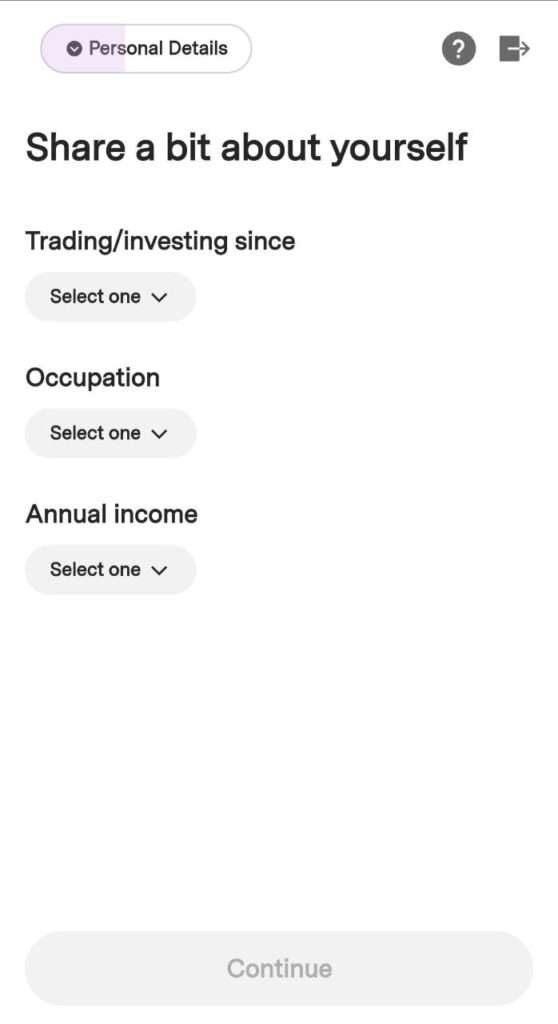

Step 2: Fill-up personal details & Upload Signature

- Fill-up the personal details

- You will also need to upload a digital copy of your signature.

- Ensure your signature is clear and matches what’s on your official documents.

Step 3: Provide PAN and Date of Birth

- Enter your PAN number and date of birth (as per PAN card records).

- Click Next to proceed.

Step 4: Choose Your Account Type

- Upstox offers different account types like Equity, Commodity, or a combination of both.

- Select the account type(s) you wish to open (Demat + Trading account).

Step 5: Provide Bank Details

- Enter your bank account number and IFSC code.

- Click Next to link your bank account with the Demat account.

Step 6: Complete KYC Process

You will need to complete your KYC (Know Your Customer) process online. Here’s what you need to do:

- Aadhaar-Based KYC: Provide your Aadhaar number and verify using the OTP sent to your Aadhaar-linked mobile number.

- Upload Documents:

- PAN Card (as identity proof).

- Address proof (Aadhaar card, passport, driving license, etc.).

- Passport-size photograph.

- Bank proof (such as a cancelled cheque or bank statement with your name, IFSC, and account number visible).

Step 7: E-Sign with Aadhaar

- After completing the KYC, you’ll be asked to e-sign the document.

- Click on the ‘E-sign’ option and verify with your Aadhaar OTP to digitally sign the application.

Step 8: Complete In-Person Verification (IPV)

- Upstox may require you to complete an In-Person Verification (IPV), which is mandatory as per SEBI guidelines.

- This step is done via a video where you’ll need to hold your PAN card and record a short video to confirm your identity.

Step 9: Pay Account Opening Fees (If Applicable)

- Upstox may charge a fee for opening a Demat account, though promotional offers sometimes waive these charges.

- Review the account opening charges and pay using NetBanking, UPI, or debit card.

Step 10: Account Activation

- Once all the steps are completed, your application will be processed.

- You will receive an email with the client ID and other account details after verification.

Step 11: Login and Start Trading

- After the account is activated, log in to the Upstox app or web platform using your credentials.

- You can now start using your Demat and Trading account to buy and sell stocks, mutual funds, or other securities.

3. Select the Right Index Fund:

Based on your financial goals, pick an appropriate index fund.

For example, Sensex and Nifty 50 for low risk carrying individual with good return.

For higher return, you can go for nifty next 50 which has high growth potential and subsequent return but comes with higher risk.

3. Initial Investment and SIP:

You can either make a lump sum investment or set up a Systematic Investment Plan (SIP) to invest regularly.

Index Funds vs. ETFs in India

Key Differences Between Index Funds and Exchange-Traded Funds (ETFs)

- Index Funds: Can be purchased and redeemed directly from a fund house, and the price is based on the net asset value (NAV) at the end of the day.

- ETFs: Traded on stock exchanges like shares, with prices fluctuating throughout the day.

Which One Is Better for Passive Income?

Both are effective for passive income, but index funds offer simplicity and are ideal for beginners, while ETFs are better for those comfortable with stock market trading.

Liquidity, Costs, and Convenience Comparison

- Index Funds: Lower liquidity but easier to manage for long-term investors.

- ETFs: Higher liquidity and typically lower expense ratios, but require a Demat account and market knowledge.

Tax Implications of Investing in Index Funds

Tax Treatment of Long-Term vs. Short-Term Capital Gains

- Short-Term Capital Gains (STCG): If units are held for less than one year, gains are taxed at 20%.

- Long-Term Capital Gains (LTCG): If held for more than one year, gains above ₹1.25 lakh are taxed at 12.5%.

Dividend Tax Implications

Dividends from index funds are added to the investor’s taxable income and taxed according to their tax slab.

How Tax Efficiency Makes Index Funds Appealing for Passive Investors

The favorable tax treatment of long-term capital gains makes index funds a tax-efficient investment option for long-term passive income seekers.

Best Index Funds in India for Passive Income (2024)

List of Top-Performing Index Funds in India

- HDFC Index Fund – Nifty 50 Plan

- UTI Nifty Index Fund

- SBI Nifty 50 Index Fund

- ICICI Prudential Nifty Next 50 Index Fund

Performance Comparison

Funds tracking the Nifty 50 and Sensex have historically delivered strong long-term returns, making them ideal for passive income investors.

Recommendations for Both Beginners and Seasoned Investors

For beginners, stick to large-cap index funds like the Nifty 50. Seasoned investors can explore sectoral or thematic funds for higher returns.

Tips for Maximizing Passive Income from Index Funds

The Power of Compounding Through Reinvestment

Reinvesting dividends can significantly boost your long-term returns, thanks to the power of compounding.

How to Automate and Set Up SIPs for Consistent Growth

Automate your investments with SIPs to regularly invest in index funds, allowing you to benefit from rupee cost averaging.

Periodic Review and Adjustment of Your Portfolio

While index funds require minimal management, it’s wise to periodically review your portfolio to ensure it aligns with your financial goals.

Common Mistakes to Avoid When Investing in Index Funds

Timing the Market vs. Staying Invested Long-Term

Avoid trying to time the market. Instead, focus on staying invested for the long term to ride out market volatility.

Ignoring Expense Ratios and Tracking Errors

High expense ratios and tracking errors can eat into your returns, so choose funds with low costs and minimal tracking deviations.

Chasing Past Performance Without Considering Future Potential

Past performance is not always indicative of future success. Always consider the growth potential of the underlying index and the broader economy.

Conclusion

Index funds are a simple yet powerful tool for building passive income in India. Their low cost, diversification, and potential for long-term growth make them an ideal choice for investors looking to secure financial independence.

Start early, invest consistently, and let the power of compounding work for you. By following the strategies outlined in this guide, you’ll be well on your way to achieving your financial goals through index fund investing.

I think the admin of this web site is really working hatd inn favor of his web site, because here every

stuff is quality based data. https://Waste-ndc.pro/community/profile/tressa79906983/