In the world of investing, long-term stock investing offers a steady and reliable path to financial success. Unlike short-term trading, which often involves higher risk and stress, long-term investing focuses on patience, discipline, and the compounding growth of wealth over time.

Updated on 26 Aug 2024, 1:06 AM IST

Credit: Pexels

Long-Term Stock Investing Strategies

Building a strong investment portfolio isn’t just about selecting individual stocks; it’s about developing a strategy that aligns with your financial goals, risk tolerance, and time horizon.

Understanding the Basics of Stock Investing

1. What is Stock Investing?

Stock investing involves purchasing shares of a company, making you a partial owner of that company.

As a shareholder, you have the potential to earn money through dividends (regular payments made by the company to its shareholders) or through capital appreciation, which is the increase in the value of the stock over time.

2. Key Concepts: Shares, Dividends, and Market Capitalization

- Shares represent units of ownership in a company. When you buy shares, you own a portion of that company and have a claim on its assets and earnings.

- Dividends are a portion of a company’s earnings distributed to shareholders. Companies that generate consistent profits often pay dividends as a way to share their success with investors.

- Market Capitalization refers to the total market value of a company’s outstanding shares. It’s calculated by multiplying the current share price by the total number of outstanding shares. Companies are often categorized as large-cap, mid-cap, or small-cap based on their market capitalization.

3. Types of Stocks: Growth vs. Value, Large-Cap vs. Small-Cap

- Growth Stocks are shares of companies expected to grow at an above-average rate compared to other companies. These stocks typically don’t pay dividends, as the companies reinvest their earnings into expansion projects.

- Value Stocks are shares of companies that are undervalued by the market. These stocks often pay dividends and are considered less risky than growth stocks.

- Large-cap stocks refer to companies with a large market capitalization, usually over $10 billion (over 20,000 crore Rs in India). These are typically established companies with a history of stable growth.

- Small-cap stocks are companies with a smaller market capitalization, typically under $2 billion (under 5,000 crore Rs in India). These stocks can offer significant growth potential but come with higher risk.

Why Long-Term Stock Investing?

1. The Power of Compounding Over Time

One of the most compelling reasons to adopt a long-term investing strategy is the power of compounding. Compounding occurs when your investment earnings generate additional earnings.

For instance, an investment of $10,000 earning an average annual return of 7% would grow to over $76,000 in 30 years, thanks to compounding.

2. Historical Performance of Long-Term Investments

Historical data consistently shows that long-term investments, especially in the stock market, tend to outperform short-term strategies. The S&P 500, a broad market index, has delivered an average annual return of around 7-10% over the past century, despite periods of volatility and economic downturns.

Investors who stayed the course during market declines and held onto their investments for the long term generally fared better than those who tried to time the market.

3. Benefits of Patience and Minimizing Market Timing

Patience is a crucial trait for long-term investors. Attempting to time the market (buying low and selling high) is notoriously difficult and can lead to poor outcomes. Even experienced investors struggle with market timing.

By adopting a long-term strategy, you can avoid the stress and potential pitfalls of trying to predict short-term market movements. Instead, focus on the overall trend of your investments, which, historically, has been upward over the long run.

Different Types of Investments & Key Points you should know before invest – (2024)

Setting Clear Investment Goals

1. Defining Your Financial Objectives

Before you start investing, it’s essential to define your financial objectives. Are you saving for retirement, a child’s education, or a down payment on a house? Your goals will determine your investment strategy, including the types of assets you choose and your time horizon.

For example, if you’re investing for retirement 30 years from now, you can afford to take on more risk with growth stocks. On the other hand, if you need the money in five years, you might opt for more conservative investments.

2. Risk Tolerance and Time Horizon

Your risk tolerance—how comfortable you are with the possibility of losing money—should align with your time horizon. Younger investors with decades until retirement can typically afford to take on more risk because they have time to recover from market downturns.

Conversely, older investors or those nearing their financial goals may prefer to reduce risk by shifting to more stable investments, such as bonds or dividend-paying stocks.

3. Aligning Goals with Investment Strategy

Once you’ve defined your goals and assessed your risk tolerance, you can align your investment strategy accordingly. For example, if your primary goal is capital appreciation, you might focus on growth stocks or real estate investments.

If income generation is more important, you might prioritize dividend-paying stocks or bonds. The key is to ensure that your investment strategy supports your financial objectives while remaining within your risk tolerance.

The Key to Risk Management: Diversification

1. What is Diversification?

Diversification involves spreading your investments across different asset classes, industries, and geographical regions to reduce risk. The idea is that by not putting all your eggs in one basket, you can protect your portfolio from significant losses if one investment underperforms.

2. Importance of Diversifying Across Sectors and Asset Classes

A well-diversified portfolio might include a mix of stocks, bonds, real estate, and other assets. Within the stock portion of your portfolio, you could diversify by investing in companies from various sectors, such as technology, healthcare, and consumer goods.

You could also include India, U.S., and international stocks to gain exposure to different economies.

3. Examples of a Diversified Portfolio

A sample diversified portfolio might include:

- 50% in a broad-market index fund (like the S&P 500)

- 20% in international stocks

- 20% in bonds or bond funds

- 10% in real estate or alternative investments

This mix provides exposure to different types of assets, helping to reduce overall portfolio risk.

Choosing the Right Stocks for Long-Term Growth

1. How to Identify High-Quality Companies

When selecting individual stocks for your long-term portfolio, focus on high-quality companies with a history of strong performance.

Look for businesses with consistent earnings growth, a solid competitive position in their industry, and effective management. These companies are more likely to weather economic downturns and continue growing over time.

2. Evaluating Financial Health: Balance Sheets, Earnings, and Cash Flow

Before investing in a company, it’s crucial to evaluate its financial health. Review the company’s balance sheet to assess its assets, liabilities, and shareholder equity. Check its earnings reports to see if profits are growing steadily.

Finally, examine cash flow statements to ensure the company generates enough cash to cover its operations and growth initiatives.

3. Importance of Competitive Advantage (Moat)

A company’s competitive advantage, or “moat,” is what sets it apart from its competitors and allows it to maintain profitability over the long term. Companies with strong moats might have a well-known brand, proprietary technology, or a dominant market position.

These factors can help protect the company from competition and contribute to long-term growth.

The Role of Index Funds and ETFs in Long-Term Investing

1. What are Index Funds and ETFs?

Index funds and exchange-traded funds (ETFs) are investment vehicles that pool money from many investors to buy a diversified portfolio of assets.

Index funds track a specific market index, such as the S&P 500, while ETFs can track indices, sectors, or specific investment strategies. Both are popular choices for long-term investors due to their diversification and low costs.

2. Benefits of Including Low-Cost Index Funds in Your Portfolio

One of the primary advantages of index funds and ETFs is their low cost. Because these funds are passively managed, they typically have lower fees than actively managed funds. Over time, lower fees can significantly impact your investment returns.

Additionally, index funds and ETFs provide instant diversification, reducing the risk of individual stock selection.

3. How to Balance Individual Stocks and Index Funds

While individual stocks can offer higher returns, they also come with more risk. By balancing your portfolio with a mix of individual stocks and index funds, you can benefit from the growth potential of specific companies while reducing overall risk through diversification.

For example, you might allocate 70% of your portfolio to index funds and 30% to individual stocks.

Regular Portfolio Review and Rebalancing

1. Why Reviewing Your Portfolio is Crucial

Regularly reviewing your portfolio is essential to ensure that it remains aligned with your investment goals and risk tolerance. Over time, some investments may outperform others, causing your asset allocation to drift from your original plan.

Reviewing your portfolio allows you to make necessary adjustments and stay on track.

2. How to Rebalance Your Portfolio

Rebalancing involves adjusting your portfolio to maintain your desired asset allocation. For example, if your target allocation is 60% stocks and 40% bonds, but stocks have grown to 70% of your portfolio, you might sell some stocks and buy more bonds to restore balance.

Rebalancing can help manage risk and ensure your portfolio remains aligned with your investment strategy.

3. Adjusting Your Strategy as Life Changes

As your financial situation or goals change, it’s essential to adjust your investment strategy. Major life events, such as marriage, the birth of a child, or retirement, may require you to revisit your asset allocation, risk tolerance, and overall strategy.

By staying flexible and adapting to changes, you can keep your portfolio on track to meet your long-term goals.

Future of Direct Selling in India – (2024)

Staying Disciplined and Avoiding Common Pitfalls

1. Emotional Investing: How to Stay Rational During Market Fluctuations

Market fluctuations are inevitable, and it’s natural to feel anxious when your investments lose value. However, making decisions based on emotions can lead to poor outcomes.

To stay disciplined, remind yourself of your long-term goals and avoid making impulsive decisions. It can also help to limit how often you check your portfolio, especially during volatile periods.

2. The Danger of Chasing Trends and Market Timing

Chasing trends—investing in the latest “hot” stock or sector—can be tempting, but it’s often a recipe for disaster. Similarly, trying to time the market by buying low and selling high is extremely difficult, even for professional investors.

Instead, focus on building a diversified portfolio that aligns with your goals and risk tolerance.

3. The Importance of Staying Informed but Not Overreacting

Staying informed about the markets and your investments is important, but it’s equally important not to overreact to short-term news. Develop a habit of regularly reading financial news and company reports, but don’t let daily market fluctuations dictate your investment decisions.

Remember, long-term investing is about patience and consistency.

Tax Considerations for Long-Term Investors

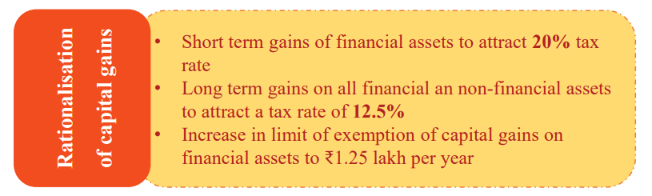

1. Understanding Capital Gains Taxes

When you sell an investment for a profit, you’re required to pay capital gains taxes on the earnings. The tax rate depends on how long you’ve held the investment. Long-term capital gains—on investments held for more than a year—are taxed at a lower rate than short-term gains.

Understanding these tax implications can help you make more informed decisions about when to sell investments.

The tax rate for short-term gains & long-term gains in India (budget 2024)

2. Tax-Advantaged Accounts: IRAs, 401(k)s, and Roth Accounts

Tax-advantaged accounts, such as IRAs, 401(k)s, and Roth accounts, offer significant tax benefits for long-term investors. Contributions to traditional IRAs and 401(k)s are tax-deductible, and earnings grow tax-deferred until withdrawal.

Roth accounts, on the other hand, allow for tax-free withdrawals in retirement, as contributions are made with after-tax dollars.

Utilizing these accounts can help you maximize your investment returns by minimizing taxes.

3. Strategies to Minimize Tax Impact

To minimize the tax impact on your investments, consider strategies such as tax-loss harvesting, where you sell losing investments to offset gains, and holding investments for more than a year to qualify for long-term capital gains rates.

Additionally, consider placing high-growth or dividend-paying investments in tax-advantaged accounts to reduce your tax burden.

Building a successful investment portfolio requires a long-term perspective, patience, and discipline. By understanding the basics of stock investing, setting clear goals, diversifying your portfolio, you can navigate the ups and downs of the market and achieve your financial objectives.

Remember, the key to long-term investing success is not about timing the market, but time in the market.

What are your long-term stock investing strategies? Share your thoughts and experiences in the comments below!